LTC Price Prediction: Technical Strength and ETF Momentum Signal Bullish Outlook

#LTC

- LTC trading above 20-day MA indicates technical strength

- Multiple ETF filings creating positive market sentiment

- Bollinger Band positioning suggests potential breakout toward $124-130

LTC Price Prediction

LTC Technical Analysis: Bullish Breakout Potential

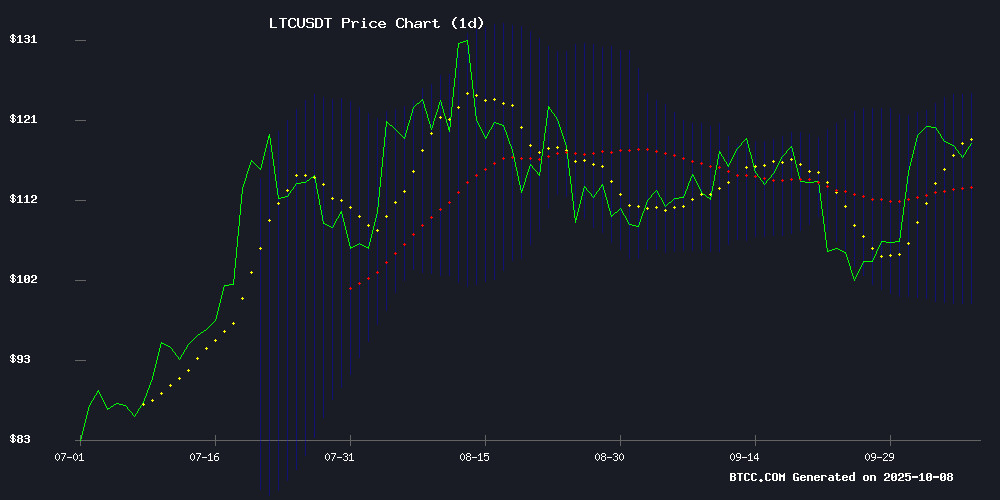

Litecoin is currently trading at $116.82, showing strength above its 20-day moving average of $111.88, according to BTCC financial analyst Sophia. The MACD indicator remains in negative territory at -2.53, suggesting some near-term pressure, but the price holding above key moving averages indicates underlying strength. The Bollinger Bands configuration, with current price positioned between the middle band at $111.88 and upper band at $124.23, suggests room for upward movement toward the $124 resistance level.

LTC Market Sentiment: ETF Optimism Drives Positive Outlook

Market sentiment for Litecoin appears increasingly bullish as ETF developments gain momentum, notes BTCC financial analyst Sophia. The recent filings for spot Litecoin ETFs by Canary Capital and growing regulatory clarity are creating positive momentum. Combined with technical indicators showing price strength above key moving averages, the convergence of fundamental and technical factors suggests Litecoin may be positioned for a breakout toward the $130 level in the near term.

Factors Influencing LTC's Price

LTC Price Eyes Breakout as ETF Momentum Builds & Technical Setup Strengthens

Litecoin's price is showing signs of resurgence after rebounding from its 200-day EMA band in early October, following a corrective phase through Q3. The asset appears primed for upward movement, fueled by rising probabilities of a spot ETF approval, strengthening on-chain activity, and growing institutional interest.

Canary's recent S-1 amendment for a Litecoin ETF (ticker: LTCC) marks a critical regulatory step toward potential approval. Bloomberg analysts note such amendments often precede final decisions, though the ongoing U.S. government shutdown introduces uncertainty around the SEC's timeline. Market confidence remains high, with Polymarket traders pricing in a 96% probability of approval.

The proposed ETF's 95 basis point fee structure has drawn attention—higher than spot Bitcoin ETFs but not uncommon for niche, first-to-market products. As Eric Balchunas observed, competition would likely drive fees down if the product gains traction.

Litecoin ETF Anticipation Grows Amid Regulatory and Market Uncertainties

Litecoin's market trajectory faces a pivotal moment as Canary Capital advances its spot ETF proposal, filing an amended S-1 with the SEC that discloses a 0.95% management fee and the ticker LTCC. Analysts interpret these procedural steps as signals of imminent approval, potentially unlocking institutional demand for LTC.

Technical analyst Ali Martinez warns of a possible retracement to $50 despite bullish ETF sentiment. Market liquidity could deepen post-launch through expanded custody solutions and tax-efficient exposure, though a looming U.S. government shutdown threatens to delay SEC deliberations.

Litecoin Eyes $130 Breakout as Ethereum Rallies; MoonBull Emerges as 2025 Dark Horse

Litecoin bulls are defending the $118 support level as traders anticipate a potential breakout toward $130. Ethereum continues its steady ascent, with technical indicators suggesting sustained upward momentum.

Meanwhile, MoonBull ($MOBU) is gaining traction as a presale project with engineered tokenomics. The protocol allocates 2% of each transaction to mechanisms designed to increase scarcity and reward long-term holders. Market observers note its ecosystem development contrasts with speculative meme coins.

While Bitcoin dominance fluctuates, altcoins are exhibiting volatile price action. Analysts highlight MoonBull's structured growth approach as particularly notable amid the noise of pump-and-dump schemes dominating social media chatter.

S&P Global Launches Hybrid Index Tracking Crypto and Blockchain Stocks

S&P Global has introduced the S&P Digital Markets 50 Index, a first-of-its-kind benchmark combining 15 cryptocurrencies and 35 blockchain-related equities. The index imposes strict criteria: each component is capped at 5% weighting, with cryptocurrencies requiring minimum $300 million market capitalization and stocks at $100 million.

Dinari, a tokenization specialist, will leverage the index to launch dShare—a tokenized investment product scheduled for release by late 2025. The hybrid structure reflects growing institutional demand for blended exposure to both digital assets and traditional equity plays in the blockchain sector.

The index follows S&P's rigorous quarterly rebalancing methodology, applying the same governance standards used for its traditional financial benchmarks. This move signals mainstream acceptance of crypto assets as legitimate portfolio components alongside established public companies.

Canary Capital Advances Spot Litecoin and Hedera ETFs with Amended SEC Filings

Canary Capital has submitted amended S-1 filings for spot Litecoin (LTC) and Hedera (HBAR) ETFs to the SEC, signaling nearing approvals. Sponsor fees are set at 95 basis points for both funds—higher than Bitcoin ETF benchmarks but deemed standard for nascent products. Tickers LTCC (Litecoin) and HBR (Hedera) were disclosed in the update.

The filings arrive amid a U.S. government shutdown that previously delayed the SEC's decision timeline. Bloomberg ETF analyst Eric Balchunas notes the documentation appears final, suggesting launch readiness pending regulatory clearance. Market observers now weigh potential demand for altcoin ETFs against Bitcoin's dominance in the institutional crypto landscape.

Is LTC a good investment?

Based on current technical indicators and market developments, Litecoin presents a compelling investment opportunity according to BTCC financial analyst Sophia. The cryptocurrency is trading above its 20-day moving average at $116.82, demonstrating technical strength, while ongoing ETF developments provide fundamental support.

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | $116.82 vs $111.88 | Bullish |

| Bollinger Band Position | Between Middle & Upper | Neutral-Bullish |

| MACD | -2.53 | Caution |

| ETF Developments | Multiple Filings | Bullish |

The combination of technical positioning and positive ETF momentum suggests Litecoin could target the $124-130 range, making it an attractive investment for those comfortable with cryptocurrency volatility.